Payment Acceptance Will Never Be The Same After The COVID-19 Pandemic

Posted onNov 13, 2021

Not your typical banking, but banking worth talking about, but the future payment solutions

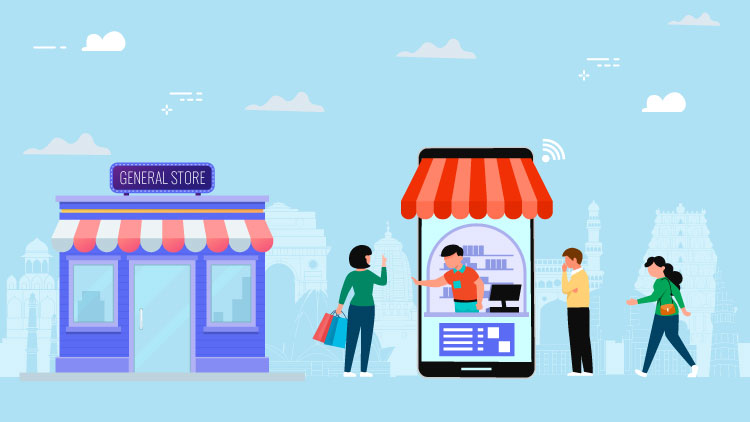

Over the past few years, mankind has seen the world of banking change tremendously. With the development of online banking (coined today as online payments), soon followed by the world of online bill payment platforms, mobile banking, mobile check deposit, person-to-person payments, digital wallets, and more have developed tremendously. These simple solutions were all made to do one thing - make a user’s life easier.

Digital payment platforms are centered on one main factor – the convenience of the user

Digital payment platform features are all trending ways a users can manage and maximize their money on the go. Payment acceptance and processing have become real-time, a lot faster than before. More to this, a user is more connected to their finances than ever before. The thought of a mobile payment platform not on a phone is almost impossible nowadays.

Questions arise as to whether digital payment platforms are actually safe?

Yes! Today’s technologies are secure and new security enhancements are made each and every day to tighten up the security. Proven technologies are used to keep your user information secure while utilizing the convenience and ease of mobile payment apps, including:

- HTTPS and 128-bit SSL encryption

- Automatic time-outs when your PC or mobile device is not in use

- Multiple layers of authentication (i.e., user ID, secret word, and password)Strict password requirements

- Masked account information or the use of nicknames for your personal account

- Fingerprint authentication

There will always be a discussion as to which banking experience is better - digital or in-person?

The experiences are similar on both the systems, yet incomparable when you get down to the details of each. While the digital platforms provide an experience that has extra ease and simplicity of completing a transaction from anywhere, at any time, there is something to be said about sitting down with a banking specialist who knows you by name. Choosing one over the other, comes down to how comfortable you feel and how much assistance you need when it comes to making your next major financial decision for your future.

Benefits of Online Digital Payment Platforms

While online banking (online payments) has many benefits, the most prominent ones are listed below:

1. Speed and Efficiency

Digital platforms make it easy for you to carry out all types of banking transactions.

Want to transfer money? Access your bank account? Monitor your expenses? You can do it all and much more digitally, without having to wait in line at a bank. Life has turned digital.

2. Online Bill Payment

One of the biggest benefits of digital platforms is online bill payment. Once you have set up your accounts with the online payment platform, all it takes is a click to make the payments. You can also easily automate the payments and track payments in and out of your account. Acceptance of payments in accounts is speeded up. Much easier than writing checks or filling forms to pay bills right?

3. Round-the-Clock Access

With the internet on your phones, your online payment platform is accessible to you 24*7. Some banks go a step further to offer a real-life customer service agent on the phone any time of the day.

4. Fewer Fees

The overhead costs of online digital platforms are low. They don’t have to pay ancillary costs like electricity, janitorial services, or rent to anyone. These savings are then passed on to the customers directly. Thus, digital payment platforms charge fewer fees than traditional banks because of low overhead costs.

CONCLUDING THOUGHTS

The future of payment solutions is definitely digital. Going digital means customized interfaces, enhanced security, and a better and larger bouquet of services that are just great for customer service. As companies and banks are exploring the potential of artificial intelligence in banking systems, digital payment channels may provide more diverse services in the future. So, the future of such a way of business is quite bright.

Online payment platforms like Payrup offer digital services, where you are able to remotely clear all your everyday transactions sitting anywhere at any point of the day at the click of a button. You can clear all your utility service bills, clear your bank credit card dues, buy insurance for your family, pay your society bills, do payments against the municipal bill, and many more things. Payrup is a make-in-India initiative where the payment system is all digital.

Join Payrup today and get your life digitized!

Visit Pay Your House Rent Instantly On Payrup!

Final Thoughts…

Popular bill payment facilities available on Payrup!

Payrup has a host of facilities that can all be paid online using our platform.

Choose to make payments for mobile prepaid, mobile postpaid, dth, electricity, landline bills, piped gas, broadband bills, water bills, e-gift cards purchases, cable tv bills, credit card bills, health insurance purchases, housing society payments, life insurance premium purchases, loan repayments, hospital payments, subscriptions, education fees, fastag payments, LPG gas bills, municipal services, and municipal taxes’ payments Payrup has it all covered for our users under one roof.

Never Miss A Post!

Subscribe to us for all the latest updates from payRup. Receive news from our team time-to-time.

Popular Blogs

.jpg)

MY AADHAR, MY FINANCIAL FREEDOM

Bank for the unbanked areas - Micro-ATM